Work Smarter, Close Faster:

AGENT AI Chatbot Handles Enquiries & Qualifies Leads 24/7 So You Can Focus on Closing Deals.

Work Smarter, Close Faster:

AGENT AI Chatbot Handles Enquiries & Qualifies Leads 24/7 So You Can Focus on Closing Deals.

About AGENT

AGENT isn't just another customer engagement solution; it's a testament to innovation and excellence. Developed by I Need Leads Ltd, a leading full-service digital marketing agency, AGENT represents the culmination of years of dedication to redefining how businesses generate and manage leads and interact with their customers.

Our mission is clear: to empower businesses of all sizes with the tools and intelligence they need to succeed in today's fast-paced digital landscape. We understand that customer engagement, sales activation, and support are the cornerstones of any successful enterprise. That's why we've poured our expertise into creating AGENT, a solution that combines advanced natural language processing, intelligent chatbots, and the latest in machine learning.

Our commitment to excellence doesn't end with development; it extends to ongoing support and evolution. AGENT is a product that adapts, learns, and grows with your business, ensuring that you stay ahead of the competition.

PERSONALISATION

Advanced natural language processing to understand each customer's unique needs, providing tailored responses and recommendations.

EFFICIENCY

A team of bots handles multiple customer queries at once, automating repetitive tasks, reducing wait times, and resolving issues quickly.

ENGAGEMENT

creation of an engaging customer journey. It not only anticipates but also fulfils customer needs, nurturing loyalty, and igniting a cycle of repeat business.

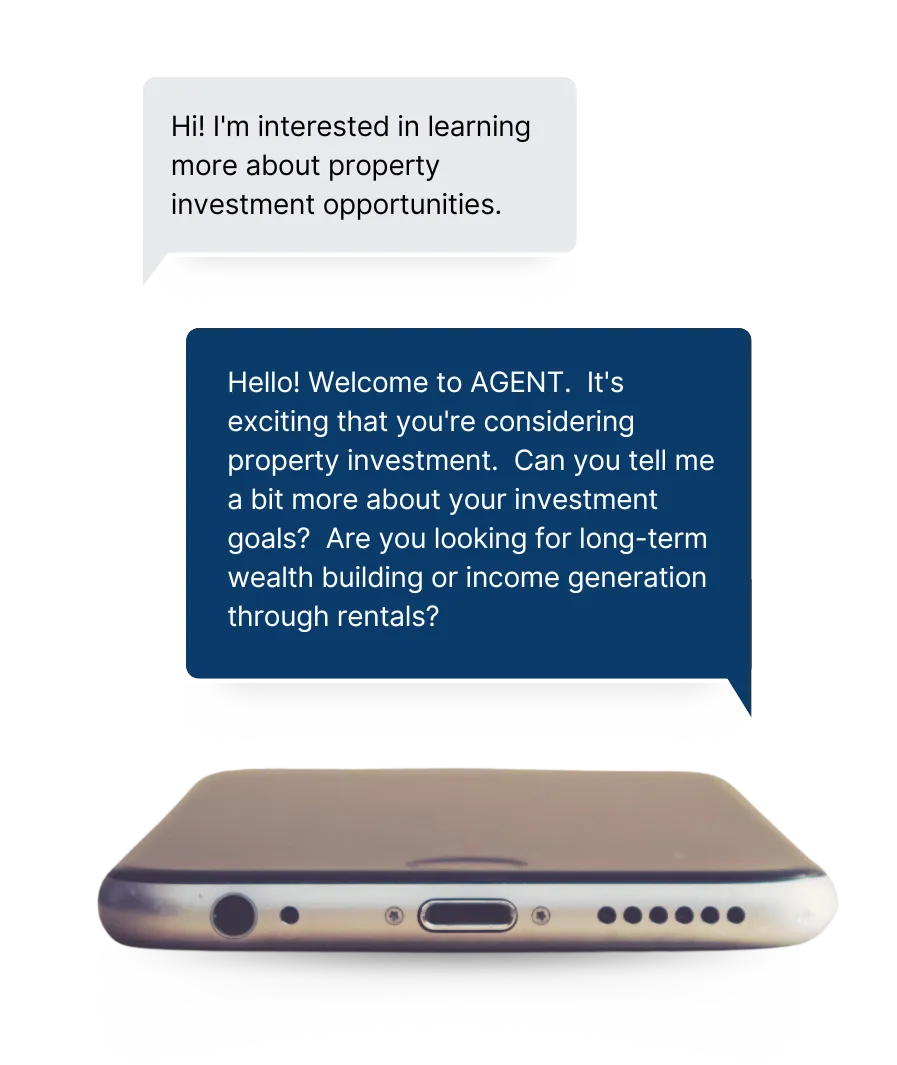

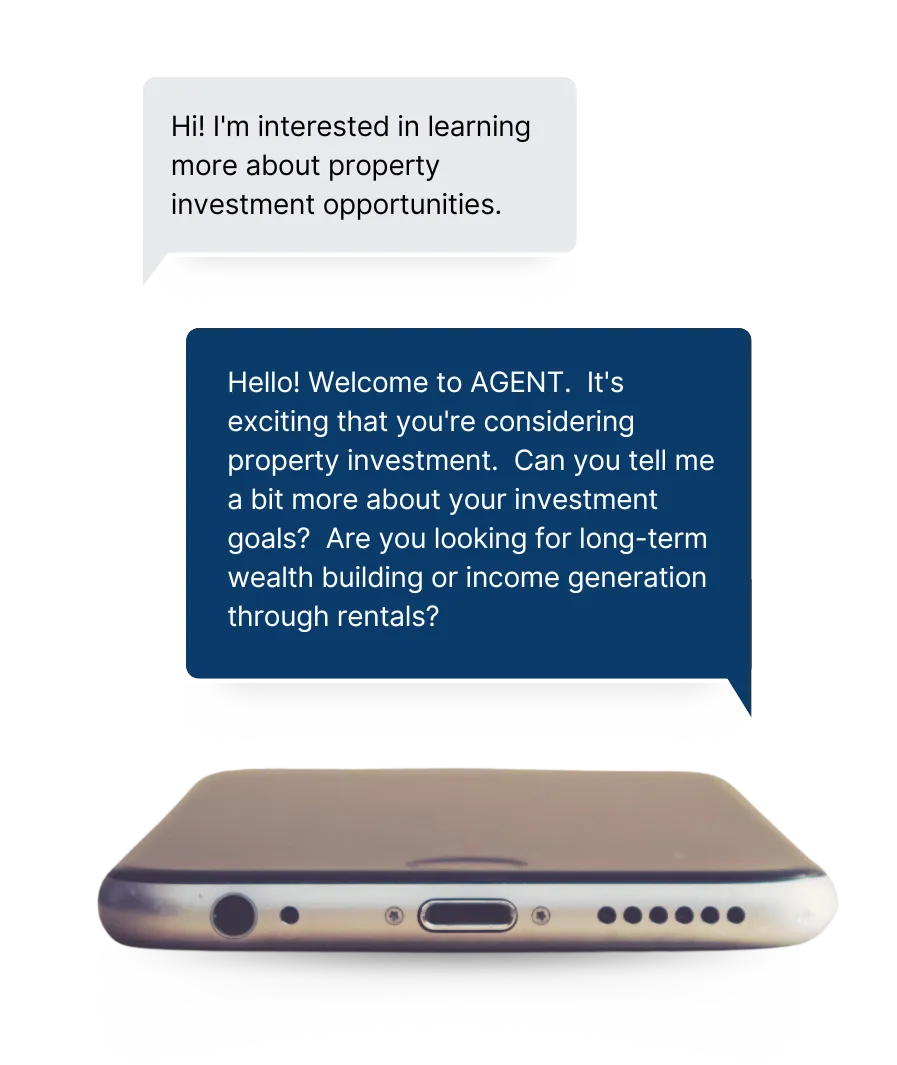

THE AGENT AI CHAT

BOT ADVANTAGE

The AGENT AI Chat Bot advantage lies in its dynamic lead qualification capabilities. Unlike generic chatbots, AGENT empowers you to design targeted conversation flows through its unique ''Objective Builder.'' This ensures you gather the most relevant information while eliminating distractions. The result? A more efficient sales funnel and higher-quality leads, all managed within the powerful AGENT platform.

About AGENT

AGENT isn't just another customer engagement solution; it's a testament to innovation and excellence. Developed by I Need Leads Ltd, a leading full-service digital marketing agency, AGENT represents the culmination of years of dedication to redefining how businesses generate and manage leads and interact with their customers.

Our mission is clear: to empower businesses of all sizes with the tools and intelligence they need to succeed in today's fast-paced digital landscape. We understand that customer engagement, sales activation, and support are the cornerstones of any successful enterprise. That's why we've poured our expertise into creating AGENT, a solution that combines advanced natural language processing, intelligent chatbots, and the latest in machine learning.

Our commitment to excellence doesn't end with development; it extends to ongoing support and evolution. AGENT is a product that adapts, learns, and grows with your business, ensuring that you stay ahead of the competition.

We’ll Show You

How It’s Done

We don't just talk about results; we demonstrate them. Our commitment to your success goes beyond words.

Join us as we walk you through real-world scenarios, showcasing how AGENT elevates customer engagement, supercharges sales activation, and revolutionizes support. Prepare to witness the future of customer interaction – because seeing is believing.

Work With Us If...

If you're ready to work with a dedicated partner, we're here to collaborate and help you achieve your goals.

You're hungry for innovation

Customer satisfaction is your priority

You're looking for increased conversions

Data-driven decisions are at the core of your business

You believe in continuous growth

Your Team Values Expertise

THE AGENT AI

CHAT BOT ADVANTAGE

The AGENT AI Chat Bot advantage lies in its dynamic lead qualification capabilities. Unlike generic chatbots, AGENT empowers you to design targeted conversation flows through its unique ''Objective Builder.'' This ensures you gather the most relevant information while eliminating distractions. The result? A more efficient sales funnel and higher-quality leads, all managed within the powerful AGENT platform.

PRECISION LEAD

QUALIFICATION:

Focus on what matters. AGENT qualifies leads accurately, saving your team time and effort.

DYNAMIC PROMPT

CONTROL:

Craft the perfect conversation. Tailor questions based on your ideal customer, ensuring you capture the most relevant information.

COST-EFFECTIVE

MESSAGING:

Reach more leads, spend less. AGENT automates lead qualification, reducing your cost per interaction compared to traditional methods.

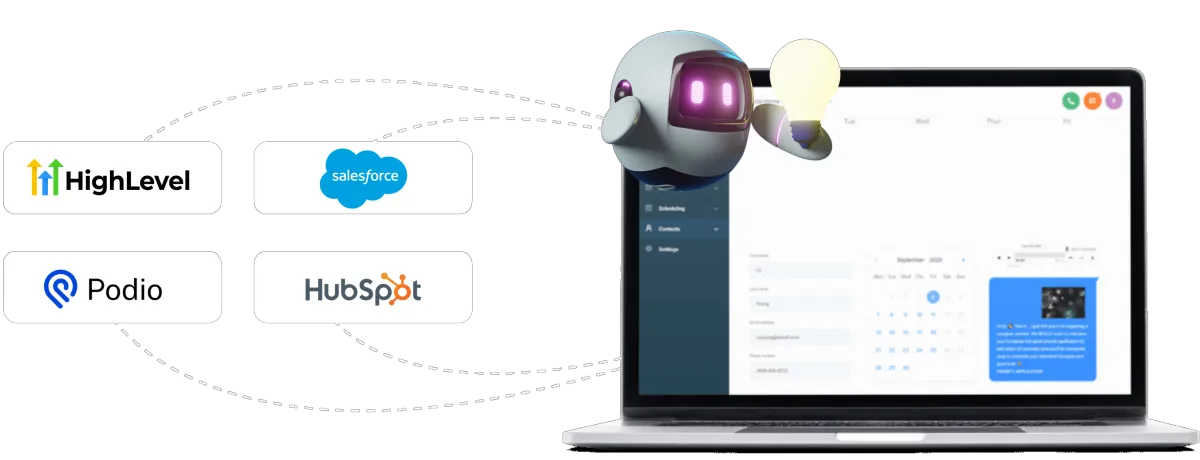

SEAMLESS CRM

INTEGRATION

Seamless data flow. Qualify leads and update your CRM directly within AGENT, streamlining your sales process.

EFFORTLESS

APPOINTMENT BOOKING:

Schedule meetings on autopilot. AGENT automates appointment booking, freeing your team to focus on closing deals.

AI TRAINING

MADE EASY:

Upload documents and leverage web scraping. Train your AGENT bot quickly and efficiently, ensuring it understands your specific needs.

THE AGENT AI CHAT BOT ADVANTAGE

The AGENT AI Chat Bot advantage lies in its dynamic lead qualification capabilities. Unlike generic chatbots, AGENT empowers you to design targeted conversation flows through its unique ''Objective Builder.'' This ensures you gather the most relevant information while eliminating distractions. The result? A more efficient sales funnel and higher-quality leads, all managed within the powerful AGENT platform.

PRECISION LEAD QUALIFICATION:

Focus on what matters. AGENT qualifies leads accurately, saving your team time and effort.

DYNAMIC PROMPT

CONTROL:

Craft the perfect conversation. Tailor questions based on your ideal customer, ensuring you capture the most relevant information.

COST-EFFECTIVE

MESSAGING:

Reach more leads, spend less. AGENT automates lead qualification, reducing your cost per interaction compared to traditional methods.

SEAMLESS CRM

INTEGRATION

Seamless data flow. Qualify leads and update your CRM directly within AGENT, streamlining your sales process.

EFFORTLESS APPOINTMENT

BOOKING:

Schedule meetings on autopilot. AGENT automates appointment booking, freeing your team to focus on closing deals.

AI TRAINING

MADE EASY:

Upload documents and leverage web scraping. Train your AGENT bot quickly and efficiently, ensuring it understands your specific needs.

Fine-Tune Lead Filtering:

Craft dynamic prompts that adapt to each interaction, zeroing in on the perfect prospects for your business.

Say Goodbye to Guesswork:

Say Goodbye to Guesswork: AGENT's AI engine cuts through distractions, ensuring your resources are invested in qualified leads who move the needle.

Seamless Field Updates:

Keep your customer data fresh and actionable with intuitive in-conversation updates. No more tedious form-filling - just natural, efficient data capture.

Appointments on Demand:

Make scheduling a breeze with built-in appointment booking. Let your bot handle the logistics, freeing up your team to focus on building relationships.

AI-Powered Cost Savings:

AGENT targets the right leads with laser precision, reducing unnecessary messaging and maximizing your ROI.

Train Your Bot:

Upload documents and leverage web scraping to continuously refine your bot's knowledge and tailor its responses to your specific needs.

Tailored Solutions:

We don't believe in one-size-fits-all. Work with our experts to craft a personalized AGENT experience that perfectly aligns with your business goals.

Constant Innovation:

Our team is always pushing the boundaries, ensuring your AGENT experience is always at the forefront of customer engagement technology.

Seamless CRM

Integration...

AGENT effortlessly integrates with your CRM platform, ensuring efficiency, data integrity, and personalisation. It automates processes, scales with your business, and works seamlessly with popular CRM systems like Salesforce and HubSpot, amplifying the power of your customer data.

Easily Qualify

Your Leads...

AGENT's advanced AI helps identify the best prospects with laser precision.

Dynamic Prompts: Custom prompts that adapt to each interaction, uncovering crucial insights about the lead's needs and budget.

AI-Powered Scoring: AGENT analyzes responses in real-time, assigning a qualification score based on your predefined criteria.

Instant Insights: Clear, actionable insights on each lead, saving time, effort, and resources for your business.

we're all about

real conversations!

AGENT enables businesses to connect with customers through meaningful dialogue. Most significantly, it goes beyond just conversation – AGENT helps you qualify leads during those interactions.

Effortless Lead Qualification: Weave natural questions into your conversations to uncover key information about your ideal customer profile. AGENT helps you qualify leads without feeling scripted or interrupting the flow of conversation.

Focus on the Right Prospects: Don't waste time chasing unqualified leads. AGENT helps you identify high-potential customers right away.

CRM Integration: Qualify leads and automatically populate your CRM within AGENT, streamlining your sales process.

we're all about real conversations!

AGENT enables businesses to connect with customers through meaningful dialogue. Most significantly, it goes beyond just conversation – AGENT helps you qualify leads during those interactions.

Effortless Lead Qualification: Weave natural questions into your conversations to uncover key information about your ideal customer profile. AGENT helps you qualify leads without feeling scripted or interrupting the flow of conversation.

Focus on the Right Prospects: Don't waste time chasing unqualified leads. AGENT helps you identify high-potential customers right away.

CRM Integration: Qualify leads and automatically populate your CRM within AGENT, streamlining your sales process.

Easily Qualify Your Leads...

AGENT's advanced AI helps identify the best prospects with laser precision.

Dynamic Prompts: Custom prompts that adapt to each interaction, uncovering crucial insights about the lead's needs and budget.

AI-Powered Scoring: AGENT analyzes responses in real-time, assigning a qualification score based on your predefined criteria.

Instant Insights: Clear, actionable insights on each lead, saving time, effort, and resources for your business.

Instant Insights: Your Ai Chat Bot has the ability to read your diary and manage bookings seamlessly.

Seamless CRM

Integration with AGENT

AGENT effortlessly integrates with your CRM platform, ensuring efficiency, data integrity, and personalisation. It automates processes, scales with your business, and works seamlessly with popular CRM systems like Salesforce and HubSpot, amplifying the power of your customer data.

Powerhouse Features

Here's a sneak peek into what

AGENT brings to the table:

Intelligent Chatbots

Smart bots working in unison for efficient customer interactions.

Personalized Interactions

Tailoring each engagement for a unique customer experience.

Effortless Multitasking

Handling multiple queries concurrently for quick resolutions.

Adaptive Intelligence

Smartly switching bots for seamless and empathetic interactions.

Continuous Learning

Constantly improving by learning from interactions and feedback.

Engagement Tools

Guiding customers with real-time recommendations, fostering loyalty.

Watch our Video

A preview of how AGENT can transform customer engagement, deliver exceptional sales activation, and enhance customer support. It's not just a chatbot; it's a dynamic solution in action.

Hear From Our Clients

Watch our Video

A preview of how AGENT can transform customer engagement, deliver exceptional sales activation, and enhance customer support.

It's not just a chatbot; it's a dynamic solution in action.

Hear From Our Clients

Easily Qualify Your Leads

Your CRM is filled with leads, but not all are equal. That's where AGENT steps in. We empower you to customise a chatbot that truly understands your business and achieves your unique lead qualification objectives.

By accurately qualifying leads, AGENT helps you focus your resources on the most promising prospects. This means higher conversion rates, improved ROI, and a more efficient sales process.

Easily Qualify Your Leads

Your CRM is filled with leads, but not all are equal. That's where AGENT steps in. We empower you to customise a chatbot that truly understands your business and achieves your unique lead qualification objectives.

By accurately qualifying leads, AGENT helps you focus your resources on the most promising prospects. This means higher conversion rates, improved ROI, and a more efficient sales process.

Read Our Latest Blogs

From maximizing sales potential to creating meaningful customer connections, our blogs are your gateway to staying ahead of the curve!

What Are the Key Features of an AI Chatbot Solution for Finance?

AI chatbots have revolutionized customer interactions in the finance industry, offering fast, efficient, and personalized service that meets the demands of today’s tech-savvy clients.

With the capability to handle routine queries, guide financial decisions, and streamline processes, AI chatbots provide invaluable support to customers and institutions.

As more financial institutions adopt chatbot solutions, understanding their key features can help businesses leverage this technology to enhance service, increase security, and improve overall customer satisfaction.

Here, we explore the essential features of an AI chatbot solution designed specifically for the finance industry.

24/7 Customer Support and Instant Response

One of the most valuable features of AI chatbots in finance is the ability to provide 24/7 customer support with instant responses to queries.

Financial institutions often deal with clients in various time zones, and customer needs can arise anytime, whether checking an account balance, reporting a lost card, or making a payment.

These bots are programmed to handle frequently asked questions and common requests, which minimizes the need for human intervention on fundamental issues.

This capability improves customer satisfaction and frees up human representatives to focus on more complex tasks.

Instant response is particularly beneficial in finance, where customers may need timely information or action, making AI chatbots essential for meeting the growing expectations of digital-era clients.

Personalized Financial Advice and Assistance

AI chatbots in finance can go beyond simple Q&A interactions by offering personalized financial advice and assistance tailored to each customer’s unique needs and financial goals.

Chatbots can make recommendations that align with their financial objectives by analysing data from a customer’s transaction history, spending patterns, and financial profile.

For example, a chatbot can suggest budgeting tips, highlight potential savings opportunities, or recommend investment options based on the client’s risk tolerance and financial goals.

Personalized assistance helps foster trust and improves customer satisfaction, as clients feel their needs are understood and addressed.

Chatbots can sometimes guide customers through loan applications or retirement planning based on their income and current financial standing.

With machine learning, chatbots can continuously refine their recommendations, making them more accurate and relevant.

This personalized approach allows financial institutions to offer value-added services, enhancing client relationships and loyalty.

Secure Transactions and Data Privacy

In the finance sector, security and data privacy are paramount. AI chatbot solutions for finance must incorporate robust security measures to handle sensitive customer information and ensure secure transactions.

Features such as encryption, multi-factor authentication, and user verification protocols help protect customer data during interactions.

Additionally, many financial chatbots are designed to detect suspicious activity and flag it for review, adding an extra layer of protection.

Since chatbots can facilitate transactions such as money transfers, bill payments, and account inquiries, they must adhere to strict regulatory standards and data protection laws.

Data privacy is also crucial, as customers expect their personal and financial information to remain confidential. Implementing robust security features in chatbots helps prevent data breaches and builds customer trust.

When customers feel confident that their data is secure, they are more likely to engage with the chatbot, increasing usage and satisfaction.

Seamless Integration with Financial Systems

A key feature of effective AI chatbots in finance is their ability to seamlessly integrate with existing financial systems, including customer relationship management (CRM) platforms, payment gateways, and account management tools.

This integration allows chatbots to access real-time information, providing accurate responses and supporting efficient transactions. For instance, a chatbot integrated with CRM can retrieve a customer’s recent activity to provide relevant updates or offer support based on past interactions.

Integration with payment systems enables chatbots to process transactions directly, allowing customers to make payments or transfer funds without leaving the chat interface.

This connectivity streamlines the customer experience and reduces manual processing for the institution, enhancing overall efficiency.

By integrating with financial systems, AI chatbots can serve as a one-stop solution for many customer needs, making financial services more accessible and convenient for users.

Global AI Chatbot Market Size Forecast 2018-2027

The global AI chatbot market is projected to experience robust growth from 2018 to 2027, driven by advancements in artificial intelligence, natural language processing, and machine learning technologies.

As businesses across various industries seek to enhance customer engagement and streamline operations, AI chatbots are becoming increasingly popular for automating communication, handling customer queries, and improving user experiences.

The rising adoption of AI-driven tools in e-commerce, banking, healthcare, and customer service further fuels the market's growth.

With AI chatbots offering benefits such as 24/7 availability, cost reduction, and personalized interactions, businesses are keen on integrating these solutions into their digital strategies.

As AI technology evolves, chatbots are expected to become more sophisticated, enabling even greater automation and seamless communication between businesses and customers. This trend is anticipated to drive continued global AI chatbot market expansion over the forecast period.

Conclusion: Enhancing Financial Services with AI Chatbots

With the ability to provide 24/7 support, deliver personalized financial insights, ensure secure transactions, and integrate seamlessly with existing economic systems, these chatbots meet the demands of modern customers while supporting operational goals.

By adopting AI chatbot solutions, financial businesses can reduce response times, improve customer engagement, and build stronger relationships.

As technology advances, AI chatbots will likely play an even more significant role in the financial sector, helping institutions adapt to evolving customer expectations and setting new standards for service excellence.

Discover the

SAVINGS with

AI vs. HUMAN SETTERS?

Navigation

Resources

I Need Leads Ltd. All Rights Reserved.

Read Our Latest Blogs

From maximising sales potential to creating meaningful customer

connections, our blogs are your gateway to staying ahead of the curve!

What Are the Key Features of an AI Chatbot Solution for Finance?

AI chatbots have revolutionized customer interactions in the finance industry, offering fast, efficient, and personalized service that meets the demands of today’s tech-savvy clients.

With the capability to handle routine queries, guide financial decisions, and streamline processes, AI chatbots provide invaluable support to customers and institutions.

As more financial institutions adopt chatbot solutions, understanding their key features can help businesses leverage this technology to enhance service, increase security, and improve overall customer satisfaction.

Here, we explore the essential features of an AI chatbot solution designed specifically for the finance industry.

24/7 Customer Support and Instant Response

One of the most valuable features of AI chatbots in finance is the ability to provide 24/7 customer support with instant responses to queries.

Financial institutions often deal with clients in various time zones, and customer needs can arise anytime, whether checking an account balance, reporting a lost card, or making a payment.

These bots are programmed to handle frequently asked questions and common requests, which minimizes the need for human intervention on fundamental issues.

This capability improves customer satisfaction and frees up human representatives to focus on more complex tasks.

Instant response is particularly beneficial in finance, where customers may need timely information or action, making AI chatbots essential for meeting the growing expectations of digital-era clients.

Personalized Financial Advice and Assistance

AI chatbots in finance can go beyond simple Q&A interactions by offering personalized financial advice and assistance tailored to each customer’s unique needs and financial goals.

Chatbots can make recommendations that align with their financial objectives by analysing data from a customer’s transaction history, spending patterns, and financial profile.

For example, a chatbot can suggest budgeting tips, highlight potential savings opportunities, or recommend investment options based on the client’s risk tolerance and financial goals.

Personalized assistance helps foster trust and improves customer satisfaction, as clients feel their needs are understood and addressed.

Chatbots can sometimes guide customers through loan applications or retirement planning based on their income and current financial standing.

With machine learning, chatbots can continuously refine their recommendations, making them more accurate and relevant.

This personalized approach allows financial institutions to offer value-added services, enhancing client relationships and loyalty.

Secure Transactions and Data Privacy

In the finance sector, security and data privacy are paramount. AI chatbot solutions for finance must incorporate robust security measures to handle sensitive customer information and ensure secure transactions.

Features such as encryption, multi-factor authentication, and user verification protocols help protect customer data during interactions.

Additionally, many financial chatbots are designed to detect suspicious activity and flag it for review, adding an extra layer of protection.

Since chatbots can facilitate transactions such as money transfers, bill payments, and account inquiries, they must adhere to strict regulatory standards and data protection laws.

Data privacy is also crucial, as customers expect their personal and financial information to remain confidential. Implementing robust security features in chatbots helps prevent data breaches and builds customer trust.

When customers feel confident that their data is secure, they are more likely to engage with the chatbot, increasing usage and satisfaction.

Seamless Integration with Financial Systems

A key feature of effective AI chatbots in finance is their ability to seamlessly integrate with existing financial systems, including customer relationship management (CRM) platforms, payment gateways, and account management tools.

This integration allows chatbots to access real-time information, providing accurate responses and supporting efficient transactions. For instance, a chatbot integrated with CRM can retrieve a customer’s recent activity to provide relevant updates or offer support based on past interactions.

Integration with payment systems enables chatbots to process transactions directly, allowing customers to make payments or transfer funds without leaving the chat interface.

This connectivity streamlines the customer experience and reduces manual processing for the institution, enhancing overall efficiency.

By integrating with financial systems, AI chatbots can serve as a one-stop solution for many customer needs, making financial services more accessible and convenient for users.

Global AI Chatbot Market Size Forecast 2018-2027

The global AI chatbot market is projected to experience robust growth from 2018 to 2027, driven by advancements in artificial intelligence, natural language processing, and machine learning technologies.

As businesses across various industries seek to enhance customer engagement and streamline operations, AI chatbots are becoming increasingly popular for automating communication, handling customer queries, and improving user experiences.

The rising adoption of AI-driven tools in e-commerce, banking, healthcare, and customer service further fuels the market's growth.

With AI chatbots offering benefits such as 24/7 availability, cost reduction, and personalized interactions, businesses are keen on integrating these solutions into their digital strategies.

As AI technology evolves, chatbots are expected to become more sophisticated, enabling even greater automation and seamless communication between businesses and customers. This trend is anticipated to drive continued global AI chatbot market expansion over the forecast period.

Conclusion: Enhancing Financial Services with AI Chatbots

With the ability to provide 24/7 support, deliver personalized financial insights, ensure secure transactions, and integrate seamlessly with existing economic systems, these chatbots meet the demands of modern customers while supporting operational goals.

By adopting AI chatbot solutions, financial businesses can reduce response times, improve customer engagement, and build stronger relationships.

As technology advances, AI chatbots will likely play an even more significant role in the financial sector, helping institutions adapt to evolving customer expectations and setting new standards for service excellence.

Discover the SAVINGS with

AI vs. HUMAN SETTERS?

Navigation

Resources

NAVIGATION