Work Smarter, Close Faster:

AGENT AI Chatbot Handles Enquiries & Qualifies Leads 24/7 So You Can Focus on Closing Deals.

Our AI-powered solution delivers human-like responses, transforming the way you interact with leads and customers and driving business growth.

About AGENT

AGENT isn't just another customer engagement solution; it's a testament to innovation and excellence. Developed by I Need Leads Ltd, a leading full-service digital marketing agency, AGENT represents the culmination of years of dedication to redefining how businesses generate and manage leads and interact with their customers.

Our mission is clear: to empower businesses of all sizes with the tools and intelligence they need to succeed in today's fast-paced digital landscape. We understand that customer engagement, sales activation, and support are the cornerstones of any successful enterprise. That's why we've poured our expertise into creating AGENT, a solution that combines advanced natural language processing, intelligent chatbots, and the latest in machine learning.

Our commitment to excellence doesn't end with development; it extends to ongoing support and evolution. AGENT is a product that adapts, learns, and grows with your business, ensuring that you stay ahead of the competition.

PERSONALISATION

Advanced natural language processing to understand each customer's unique needs, providing tailored responses and recommendations.

EFFICIENCY

A team of bots handles multiple customer queries at once, automating repetitive tasks, reducing wait times, and resolving issues quickly.

ENGAGEMENT

creation of an engaging customer journey. It not only anticipates but also fulfils customer needs, nurturing loyalty, and igniting a cycle of repeat business.

THE AGENT AI CHAT

BOT ADVANTAGE

The AGENT AI Chat Bot advantage lies in its dynamic lead qualification capabilities. Unlike generic chatbots, AGENT empowers you to design targeted conversation flows through its unique ''Objective Builder.'' This ensures you gather the most relevant information while eliminating distractions. The result? A more efficient sales funnel and higher-quality leads, all managed within the powerful AGENT platform.

About AGENT

AGENT isn't just another customer engagement solution; it's a testament to innovation and excellence. Developed by I Need Leads Ltd, a leading full-service digital marketing agency, AGENT represents the culmination of years of dedication to redefining how businesses generate and manage leads and interact with their customers.

Our mission is clear: to empower businesses of all sizes with the tools and intelligence they need to succeed in today's fast-paced digital landscape. We understand that customer engagement, sales activation, and support are the cornerstones of any successful enterprise. That's why we've poured our expertise into creating AGENT, a solution that combines advanced natural language processing, intelligent chatbots, and the latest in machine learning.

Our commitment to excellence doesn't end with development; it extends to ongoing support and evolution. AGENT is a product that adapts, learns, and grows with your business, ensuring that you stay ahead of the competition.

We’ll Show You

How It’s Done

We don't just talk about results; we demonstrate them. Our commitment to your success goes beyond words.

Join us as we walk you through real-world scenarios, showcasing how AGENT elevates customer engagement, supercharges sales activation, and revolutionizes support. Prepare to witness the future of customer interaction – because seeing is believing.

Work With Us If...

If you're ready to work with a dedicated partner, we're here to collaborate and help you achieve your goals.

You're hungry for innovation

Customer satisfaction is your priority

You're looking for increased conversions

Data-driven decisions are at the core of your business

You believe in continuous growth

Your Team Values Expertise

THE AGENT AI

CHAT BOT ADVANTAGE

The AGENT AI Chat Bot advantage lies in its dynamic lead qualification capabilities. Unlike generic chatbots, AGENT empowers you to design targeted conversation flows through its unique ''Objective Builder.'' This ensures you gather the most relevant information while eliminating distractions. The result? A more efficient sales funnel and higher-quality leads, all managed within the powerful AGENT platform.

PRECISION LEAD

QUALIFICATION:

Focus on what matters. AGENT qualifies leads accurately, saving your team time and effort.

DYNAMIC PROMPT

CONTROL:

Craft the perfect conversation. Tailor questions based on your ideal customer, ensuring you capture the most relevant information.

COST-EFFECTIVE

MESSAGING:

Reach more leads, spend less. AGENT automates lead qualification, reducing your cost per interaction compared to traditional methods.

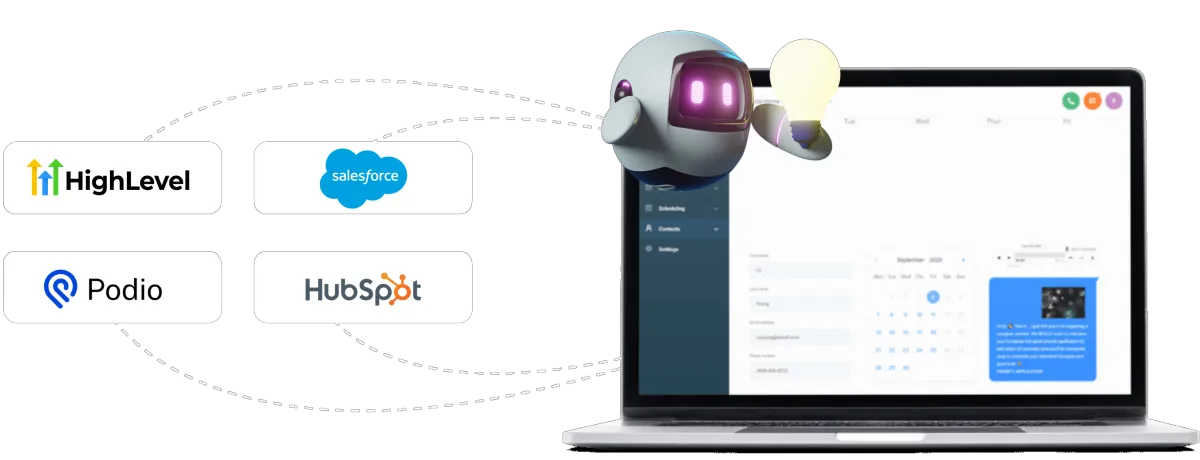

SEAMLESS CRM

INTEGRATION

Seamless data flow. Qualify leads and update your CRM directly within AGENT, streamlining your sales process.

EFFORTLESS

APPOINTMENT BOOKING:

Schedule meetings on autopilot. AGENT automates appointment booking, freeing your team to focus on closing deals.

AI TRAINING

MADE EASY:

Upload documents and leverage web scraping. Train your AGENT bot quickly and efficiently, ensuring it understands your specific needs.

THE AGENT AI CHAT BOT ADVANTAGE

The AGENT AI Chat Bot advantage lies in its dynamic lead qualification capabilities. Unlike generic chatbots, AGENT empowers you to design targeted conversation flows through its unique ''Objective Builder.'' This ensures you gather the most relevant information while eliminating distractions. The result? A more efficient sales funnel and higher-quality leads, all managed within the powerful AGENT platform.

PRECISION LEAD QUALIFICATION:

Focus on what matters. AGENT qualifies leads accurately, saving your team time and effort.

DYNAMIC PROMPT

CONTROL:

Craft the perfect conversation. Tailor questions based on your ideal customer, ensuring you capture the most relevant information.

COST-EFFECTIVE

MESSAGING:

Reach more leads, spend less. AGENT automates lead qualification, reducing your cost per interaction compared to traditional methods.

SEAMLESS CRM

INTEGRATION

Seamless data flow. Qualify leads and update your CRM directly within AGENT, streamlining your sales process.

EFFORTLESS APPOINTMENT

BOOKING:

Schedule meetings on autopilot. AGENT automates appointment booking, freeing your team to focus on closing deals.

AI TRAINING

MADE EASY:

Upload documents and leverage web scraping. Train your AGENT bot quickly and efficiently, ensuring it understands your specific needs.

Fine-Tune Lead Filtering:

Craft dynamic prompts that adapt to each interaction, zeroing in on the perfect prospects for your business.

Say Goodbye to Guesswork:

Say Goodbye to Guesswork: AGENT's AI engine cuts through distractions, ensuring your resources are invested in qualified leads who move the needle.

Seamless Field Updates:

Keep your customer data fresh and actionable with intuitive in-conversation updates. No more tedious form-filling - just natural, efficient data capture.

Appointments on Demand:

Make scheduling a breeze with built-in appointment booking. Let your bot handle the logistics, freeing up your team to focus on building relationships.

AI-Powered Cost Savings:

AGENT targets the right leads with laser precision, reducing unnecessary messaging and maximizing your ROI.

Train Your Bot:

Upload documents and leverage web scraping to continuously refine your bot's knowledge and tailor its responses to your specific needs.

Tailored Solutions:

We don't believe in one-size-fits-all. Work with our experts to craft a personalized AGENT experience that perfectly aligns with your business goals.

Constant Innovation:

Our team is always pushing the boundaries, ensuring your AGENT experience is always at the forefront of customer engagement technology.

Seamless CRM

Integration...

AGENT effortlessly integrates with your CRM platform, ensuring efficiency, data integrity, and personalisation. It automates processes, scales with your business, and works seamlessly with popular CRM systems like Salesforce and HubSpot, amplifying the power of your customer data.

Easily Qualify

Your Leads...

AGENT's advanced AI helps identify the best prospects with laser precision.

Dynamic Prompts: Custom prompts that adapt to each interaction, uncovering crucial insights about the lead's needs and budget.

AI-Powered Scoring: AGENT analyzes responses in real-time, assigning a qualification score based on your predefined criteria.

Instant Insights: Clear, actionable insights on each lead, saving time, effort, and resources for your business.

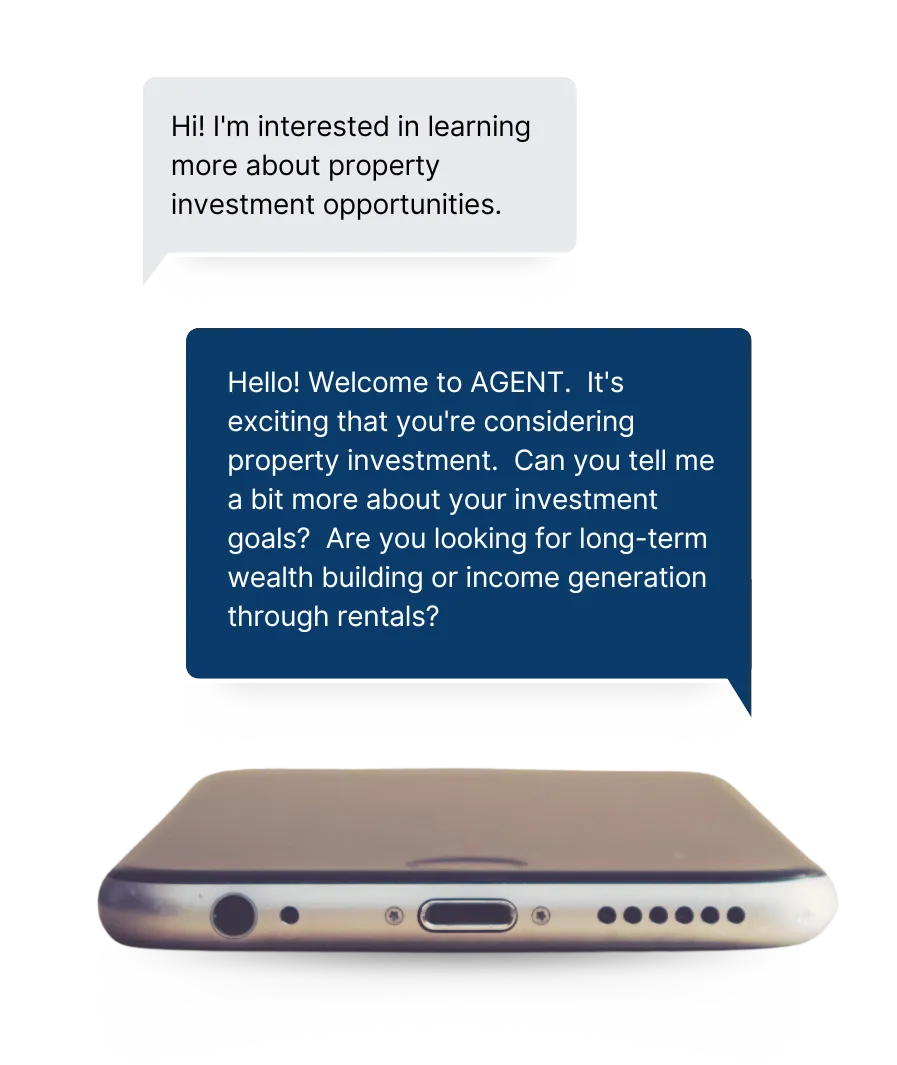

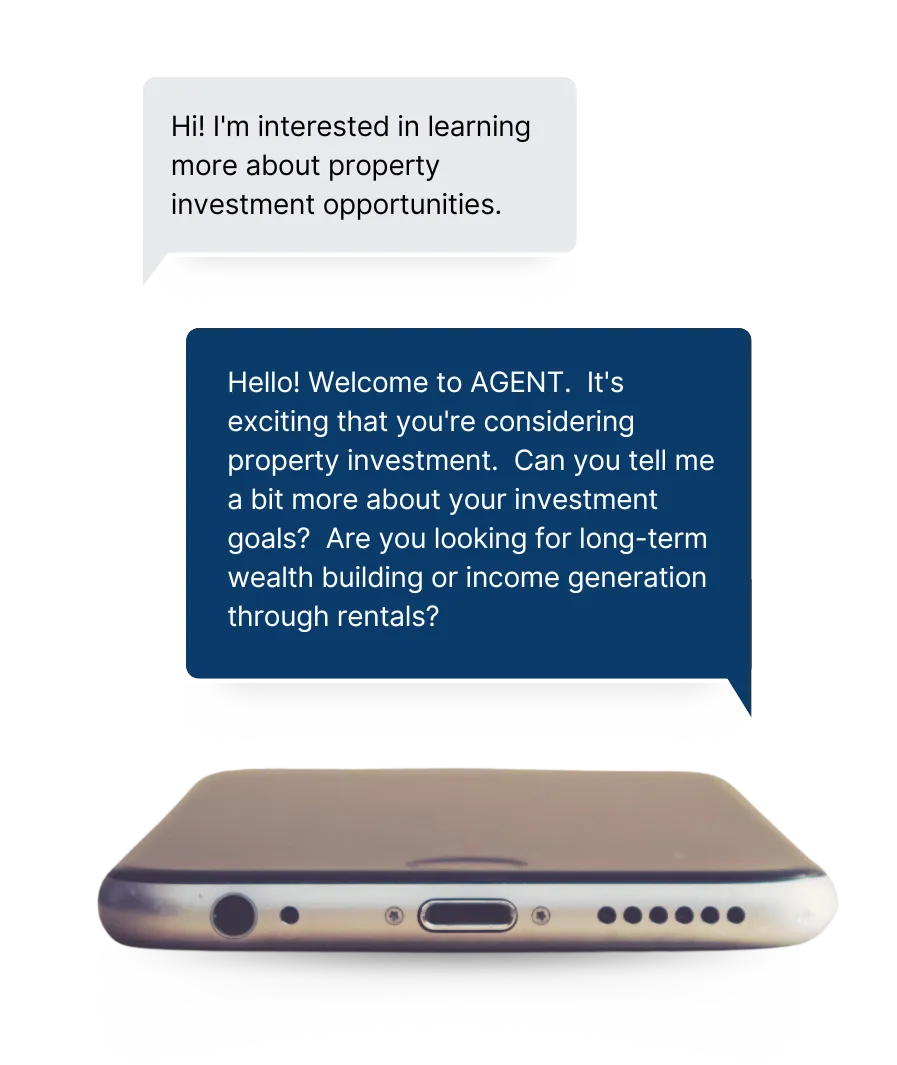

we're all about

real conversations!

AGENT enables businesses to connect with customers through meaningful dialogue. Most significantly, it goes beyond just conversation – AGENT helps you qualify leads during those interactions.

Effortless Lead Qualification: Weave natural questions into your conversations to uncover key information about your ideal customer profile. AGENT helps you qualify leads without feeling scripted or interrupting the flow of conversation.

Focus on the Right Prospects: Don't waste time chasing unqualified leads. AGENT helps you identify high-potential customers right away.

CRM Integration: Qualify leads and automatically populate your CRM within AGENT, streamlining your sales process.

we're all about real conversations!

AGENT enables businesses to connect with customers through meaningful dialogue. Most significantly, it goes beyond just conversation – AGENT helps you qualify leads during those interactions.

Effortless Lead Qualification: Weave natural questions into your conversations to uncover key information about your ideal customer profile. AGENT helps you qualify leads without feeling scripted or interrupting the flow of conversation.

Focus on the Right Prospects: Don't waste time chasing unqualified leads. AGENT helps you identify high-potential customers right away.

CRM Integration: Qualify leads and automatically populate your CRM within AGENT, streamlining your sales process.

Easily Qualify Your Leads...

AGENT's advanced AI helps identify the best prospects with laser precision.

Dynamic Prompts: Custom prompts that adapt to each interaction, uncovering crucial insights about the lead's needs and budget.

AI-Powered Scoring: AGENT analyzes responses in real-time, assigning a qualification score based on your predefined criteria.

Instant Insights: Clear, actionable insights on each lead, saving time, effort, and resources for your business.

Instant Insights: Your Ai Chat Bot has the ability to read your diary and manage bookings seamlessly.

Seamless CRM

Integration with AGENT

AGENT effortlessly integrates with your CRM platform, ensuring efficiency, data integrity, and personalisation. It automates processes, scales with your business, and works seamlessly with popular CRM systems like Salesforce and HubSpot, amplifying the power of your customer data.

Powerhouse Features

Here's a sneak peek into what

AGENT brings to the table:

Intelligent Chatbots

Smart bots working in unison for efficient customer interactions.

Personalized Interactions

Tailoring each engagement for a unique customer experience.

Effortless Multitasking

Handling multiple queries concurrently for quick resolutions.

Adaptive Intelligence

Smartly switching bots for seamless and empathetic interactions.

Continuous Learning

Constantly improving by learning from interactions and feedback.

Engagement Tools

Guiding customers with real-time recommendations, fostering loyalty.

Watch our Video

A preview of how AGENT can transform customer engagement, deliver exceptional sales activation, and enhance customer support. It's not just a chatbot; it's a dynamic solution in action.

Hear From Our Clients

Watch our Video

A preview of how AGENT can transform customer engagement, deliver exceptional sales activation, and enhance customer support.

It's not just a chatbot; it's a dynamic solution in action.

Hear From Our Clients

Easily Qualify Your Leads

Your CRM is filled with leads, but not all are equal. That's where AGENT steps in. We empower you to customise a chatbot that truly understands your business and achieves your unique lead qualification objectives.

By accurately qualifying leads, AGENT helps you focus your resources on the most promising prospects. This means higher conversion rates, improved ROI, and a more efficient sales process.

Easily Qualify Your Leads

Your CRM is filled with leads, but not all are equal. That's where AGENT steps in. We empower you to customise a chatbot that truly understands your business and achieves your unique lead qualification objectives.

By accurately qualifying leads, AGENT helps you focus your resources on the most promising prospects. This means higher conversion rates, improved ROI, and a more efficient sales process.

Read Our Latest

Blogs & Articles

From maximizing sales potential to creating meaningful customer connections, our blogs and articles are your gateway to staying ahead of the curve!

The Role of AI in Finance: Transforming the Industry for the Better

The Role of AI in Finance: Transforming the Industry for the Better

The financial industry has always been at the forefront of adopting cutting-edge technology, and artificial intelligence (AI) is rapidly becoming one of the most transformative forces in this sector. From automated trading to personalized financial advice, AI is reshaping how financial services are delivered, improving efficiency, reducing risk, and enhancing customer experiences.

At The I Need Agent, we specialize in leveraging AI to bring innovative solutions to the finance industry. This blog explores the various applications of AI in finance, its benefits, and how businesses can harness its potential to stay ahead in a competitive landscape.

What is AI in Finance?

Artificial intelligence in finance refers to the use of machine learning algorithms, data analytics, and automation technologies to analyze, interpret, and process financial data in real time. By simulating human intelligence, AI helps finance professionals make smarter decisions, optimize processes, and improve financial outcomes.

The integration of AI into financial services allows institutions to handle large volumes of data and transactions with higher accuracy and speed, all while reducing human error. Here are some key areas where AI is making a significant impact:

Risk Management

Fraud Detection

Algorithmic Trading

Customer Support

Personalized Financial Advice

By integrating AI into their operations, financial institutions can unlock new opportunities for growth, improve decision-making, and deliver enhanced services to their clients.

How AI is Revolutionizing Key Areas of Finance

AI is making waves across various aspects of the finance industry, providing solutions that drive innovation and efficiency. Here’s how AI is transforming key areas:

Risk Management and Compliance

AI can significantly enhance risk management processes by identifying patterns, analyzing data, and predicting potential risks before they escalate. Machine learning algorithms can analyze historical data and market trends to identify emerging risks related to credit, market volatility, and liquidity. This helps financial institutions take proactive steps to mitigate risks and maintain stability.

AI-powered compliance tools also ensure that financial institutions adhere to evolving regulatory standards by automating compliance checks and reducing the risk of human error. By leveraging AI, businesses can stay compliant while reducing the administrative burden on compliance teams.

Fraud Detection and Prevention

Fraud is a major concern in the financial sector, and traditional fraud detection methods can be slow and inefficient. AI revolutionizes this area by continuously monitoring transactions and flagging any unusual patterns or suspicious activities. Machine learning algorithms can detect anomalies in real time, making it possible to identify fraudulent activities before they cause significant damage.

With AI, financial institutions can apply advanced analytics to detect complex fraud schemes, reduce false positives, and improve overall security. AI also enables more accurate identity verification, ensuring that only authorized individuals have access to financial accounts.

Algorithmic Trading

One of the most high-profile applications of AI in finance is in algorithmic trading. AI algorithms can analyze vast amounts of market data, identify patterns, and execute trades at speeds that humans cannot match. These systems are capable of learning from historical data, adapting to changing market conditions, and optimizing trading strategies in real time.

AI-powered trading systems are increasingly being used by hedge funds, investment banks, and other financial institutions to maximize profits and minimize risks. These algorithms can process news events, economic data, and social media sentiment to predict market movements and execute trades with precision.

Customer Support and Service

AI-powered chatbots and virtual assistants are transforming customer service in the finance industry. These AI tools can handle customer inquiries, provide real-time updates, and assist with transactions 24/7, improving both the customer experience and operational efficiency.

Chatbots can assist with a range of services, including answering questions about account balances, processing loan applications, and providing personalized financial recommendations. With AI, businesses can provide faster, more efficient customer support while reducing the need for human intervention.

Personalized Financial Advice

AI is also playing a crucial role in personalizing financial services. By analyzing customer data, including spending habits, income, and investment preferences, AI can provide personalized financial advice and recommendations tailored to each individual’s needs.

Robot-advisors, powered by AI, offer low-cost, automated financial advice to clients by using algorithms to create and manage investment portfolios. These platforms take into account factors like risk tolerance, financial goals, and market conditions, allowing investors to receive personalized advice without the need for human financial advisors.

Benefits of AI in Finance

The integration of AI in finance offers numerous benefits that can help financial institutions operate more efficiently, reduce costs, and improve customer satisfaction. Here are some key advantages:

Increased Efficiency

AI automates many time-consuming tasks, such as data analysis, risk assessments, and transaction processing. This not only speeds up operations but also reduces human error and frees up employees to focus on more strategic tasks.

Improved Decision-Making

By analyzing vast amounts of data, AI provides financial institutions with deeper insights, allowing them to make more informed decisions. Whether it’s assessing credit risk or determining optimal investment strategies, AI can process information at a scale and speed that humans cannot.

Cost Savings

AI reduces operational costs by automating processes and improving efficiency. For example, AI-driven fraud detection systems can prevent financial losses, while AI-powered chatbots reduce the need for large customer service teams. Over time, these savings can significantly impact a business’s bottom line.

Enhanced Customer Experience

AI improves the customer experience by offering personalized services, faster response times, and better-targeted financial advice. With AI, businesses can provide customers with relevant product recommendations, real-time assistance, and proactive solutions that enhance satisfaction and loyalty.

Why Choose The I Need Agent for AI in Finance Solutions?

At The I Need Agent, we specialize in integrating AI into the finance industry to help businesses optimize their operations and achieve better results. Our expert team provides cutting-edge AI solutions that enhance efficiency, reduce costs, and improve customer service. Here’s why we’re the right choice for your AI needs:

Expertise in AI and Finance

With years of experience in both AI and finance, we understand the complexities of the industry and can tailor our solutions to meet your specific requirements.Customized Solutions

We don’t believe in one-size-fits-all solutions. Our team works with you to develop AI strategies that align with your business goals and objectives.Seamless Integration

Our AI solutions are designed to integrate seamlessly with your existing systems, ensuring a smooth transition without disrupting your operations.Continuous Support

We offer ongoing support to help you optimize and refine your AI systems, ensuring you continue to benefit from the latest advancements in AI technology.

Conclusion: Embrace the Future of Finance with AI

AI is transforming the financial industry, offering businesses new opportunities to improve efficiency, reduce risk, and provide better services to their clients. Whether you are looking to optimize trading strategies, enhance customer support, or improve risk management, AI can deliver the insights and capabilities your business needs to thrive.

At The I Need Agent, we are committed to helping you harness the power of AI to achieve your financial goals. Contact us today to learn more about how our AI in finance solutions can take your business to the next level.

Discover the

SAVINGS with

AI vs. HUMAN SETTERS?

Navigation

Resources

I Need Leads Ltd. All Rights Reserved.

Read Our Latest Blogs & Articles

From maximising sales potential to creating meaningful customer

connections, our blogs and articles are your gateway to staying ahead of the curve!

The Role of AI in Finance: Transforming the Industry for the Better

The Role of AI in Finance: Transforming the Industry for the Better

The financial industry has always been at the forefront of adopting cutting-edge technology, and artificial intelligence (AI) is rapidly becoming one of the most transformative forces in this sector. From automated trading to personalized financial advice, AI is reshaping how financial services are delivered, improving efficiency, reducing risk, and enhancing customer experiences.

At The I Need Agent, we specialize in leveraging AI to bring innovative solutions to the finance industry. This blog explores the various applications of AI in finance, its benefits, and how businesses can harness its potential to stay ahead in a competitive landscape.

What is AI in Finance?

Artificial intelligence in finance refers to the use of machine learning algorithms, data analytics, and automation technologies to analyze, interpret, and process financial data in real time. By simulating human intelligence, AI helps finance professionals make smarter decisions, optimize processes, and improve financial outcomes.

The integration of AI into financial services allows institutions to handle large volumes of data and transactions with higher accuracy and speed, all while reducing human error. Here are some key areas where AI is making a significant impact:

Risk Management

Fraud Detection

Algorithmic Trading

Customer Support

Personalized Financial Advice

By integrating AI into their operations, financial institutions can unlock new opportunities for growth, improve decision-making, and deliver enhanced services to their clients.

How AI is Revolutionizing Key Areas of Finance

AI is making waves across various aspects of the finance industry, providing solutions that drive innovation and efficiency. Here’s how AI is transforming key areas:

Risk Management and Compliance

AI can significantly enhance risk management processes by identifying patterns, analyzing data, and predicting potential risks before they escalate. Machine learning algorithms can analyze historical data and market trends to identify emerging risks related to credit, market volatility, and liquidity. This helps financial institutions take proactive steps to mitigate risks and maintain stability.

AI-powered compliance tools also ensure that financial institutions adhere to evolving regulatory standards by automating compliance checks and reducing the risk of human error. By leveraging AI, businesses can stay compliant while reducing the administrative burden on compliance teams.

Fraud Detection and Prevention

Fraud is a major concern in the financial sector, and traditional fraud detection methods can be slow and inefficient. AI revolutionizes this area by continuously monitoring transactions and flagging any unusual patterns or suspicious activities. Machine learning algorithms can detect anomalies in real time, making it possible to identify fraudulent activities before they cause significant damage.

With AI, financial institutions can apply advanced analytics to detect complex fraud schemes, reduce false positives, and improve overall security. AI also enables more accurate identity verification, ensuring that only authorized individuals have access to financial accounts.

Algorithmic Trading

One of the most high-profile applications of AI in finance is in algorithmic trading. AI algorithms can analyze vast amounts of market data, identify patterns, and execute trades at speeds that humans cannot match. These systems are capable of learning from historical data, adapting to changing market conditions, and optimizing trading strategies in real time.

AI-powered trading systems are increasingly being used by hedge funds, investment banks, and other financial institutions to maximize profits and minimize risks. These algorithms can process news events, economic data, and social media sentiment to predict market movements and execute trades with precision.

Customer Support and Service

AI-powered chatbots and virtual assistants are transforming customer service in the finance industry. These AI tools can handle customer inquiries, provide real-time updates, and assist with transactions 24/7, improving both the customer experience and operational efficiency.

Chatbots can assist with a range of services, including answering questions about account balances, processing loan applications, and providing personalized financial recommendations. With AI, businesses can provide faster, more efficient customer support while reducing the need for human intervention.

Personalized Financial Advice

AI is also playing a crucial role in personalizing financial services. By analyzing customer data, including spending habits, income, and investment preferences, AI can provide personalized financial advice and recommendations tailored to each individual’s needs.

Robot-advisors, powered by AI, offer low-cost, automated financial advice to clients by using algorithms to create and manage investment portfolios. These platforms take into account factors like risk tolerance, financial goals, and market conditions, allowing investors to receive personalized advice without the need for human financial advisors.

Benefits of AI in Finance

The integration of AI in finance offers numerous benefits that can help financial institutions operate more efficiently, reduce costs, and improve customer satisfaction. Here are some key advantages:

Increased Efficiency

AI automates many time-consuming tasks, such as data analysis, risk assessments, and transaction processing. This not only speeds up operations but also reduces human error and frees up employees to focus on more strategic tasks.

Improved Decision-Making

By analyzing vast amounts of data, AI provides financial institutions with deeper insights, allowing them to make more informed decisions. Whether it’s assessing credit risk or determining optimal investment strategies, AI can process information at a scale and speed that humans cannot.

Cost Savings

AI reduces operational costs by automating processes and improving efficiency. For example, AI-driven fraud detection systems can prevent financial losses, while AI-powered chatbots reduce the need for large customer service teams. Over time, these savings can significantly impact a business’s bottom line.

Enhanced Customer Experience

AI improves the customer experience by offering personalized services, faster response times, and better-targeted financial advice. With AI, businesses can provide customers with relevant product recommendations, real-time assistance, and proactive solutions that enhance satisfaction and loyalty.

Why Choose The I Need Agent for AI in Finance Solutions?

At The I Need Agent, we specialize in integrating AI into the finance industry to help businesses optimize their operations and achieve better results. Our expert team provides cutting-edge AI solutions that enhance efficiency, reduce costs, and improve customer service. Here’s why we’re the right choice for your AI needs:

Expertise in AI and Finance

With years of experience in both AI and finance, we understand the complexities of the industry and can tailor our solutions to meet your specific requirements.Customized Solutions

We don’t believe in one-size-fits-all solutions. Our team works with you to develop AI strategies that align with your business goals and objectives.Seamless Integration

Our AI solutions are designed to integrate seamlessly with your existing systems, ensuring a smooth transition without disrupting your operations.Continuous Support

We offer ongoing support to help you optimize and refine your AI systems, ensuring you continue to benefit from the latest advancements in AI technology.

Conclusion: Embrace the Future of Finance with AI

AI is transforming the financial industry, offering businesses new opportunities to improve efficiency, reduce risk, and provide better services to their clients. Whether you are looking to optimize trading strategies, enhance customer support, or improve risk management, AI can deliver the insights and capabilities your business needs to thrive.

At The I Need Agent, we are committed to helping you harness the power of AI to achieve your financial goals. Contact us today to learn more about how our AI in finance solutions can take your business to the next level.

Discover the SAVINGS with

AI vs. HUMAN SETTERS?

Navigation

Resources

NAVIGATION